Path: "Settings" > "Integrations" > Secupay

Note: If you have selected "alternative financial instrument" as your financial product because you intend to offer subordinated loans, for example, you can integrate the trustee secupay through our interface.

Setup

You will receive an overview of the contracts and documents to be submitted from our Customer Success Team. After you have filled these out and sent them to secupay, you will receive an API Key from secupay. This API Key must be inserted into the issuance at the appropriate location.

When creating the issuance, secupay can be selected as the payment service provider. Check the box "Create secupay account" to initiate the opening of your escrow account.

Additional Note: Please be aware that this function incurs a cost.

The documents that secupay requires from the issuer to open the escrow account will be automatically sent to the email address previously provided by the issuer. The issuer then sends the documents back to secupay, and in return, an API Key is generated, which must be manually inserted into the issuance.

Data Transmission

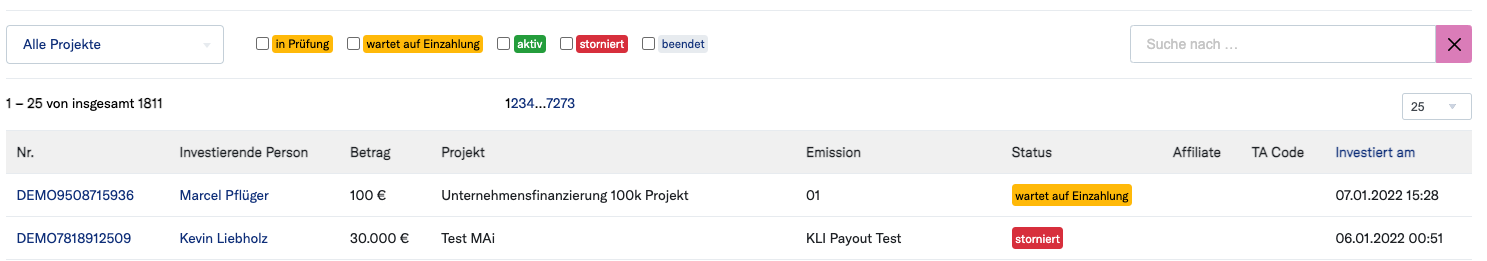

During the online investment process, in the final step of the subscription process, your investors will be prompted to transfer the funds to secupay. Once this is done, the receipt of payment is transmitted to GO through an interface. The investment status changes from "PENDING" to "ACTIVE."

Integration of Multiple Project Accounts

If you plan to open more than one project account in the future, secupay will provide you with a platform API Key through which new project accounts can be continually created. This key is provided in the "Settings" and "Integrations" in the field labeled "secupay Platform Account ID."